Nature risk reporting including TNFD and ESG

Organisations that understand their nature-related risks can make better decisions. Natural capital accounting provides the framework for organising data on nature.

Natural capital accounts can be used to understand nature-related risk. By using an accounting lens, we can look at any location in nature and reimagine it as a group of assets. Once we understand what the assets are, we can work out their condition. Are they in good health? Or do they need restoration?

This is where our analysis of risk begins. We can:

- measure exposure to nature-related risks

- assess financial implications on the balance sheet and profit and loss

- determine levels of degradation of ecosystem services

- account for ecosystem tipping points and thresholds

- run scenario analysis for nature-related risks

- develop metrics for opportunities.

Importantly, we can produce data-backed transition plans for nature-positive outcomes, supporting organisations to grasp opportunities as they arise.

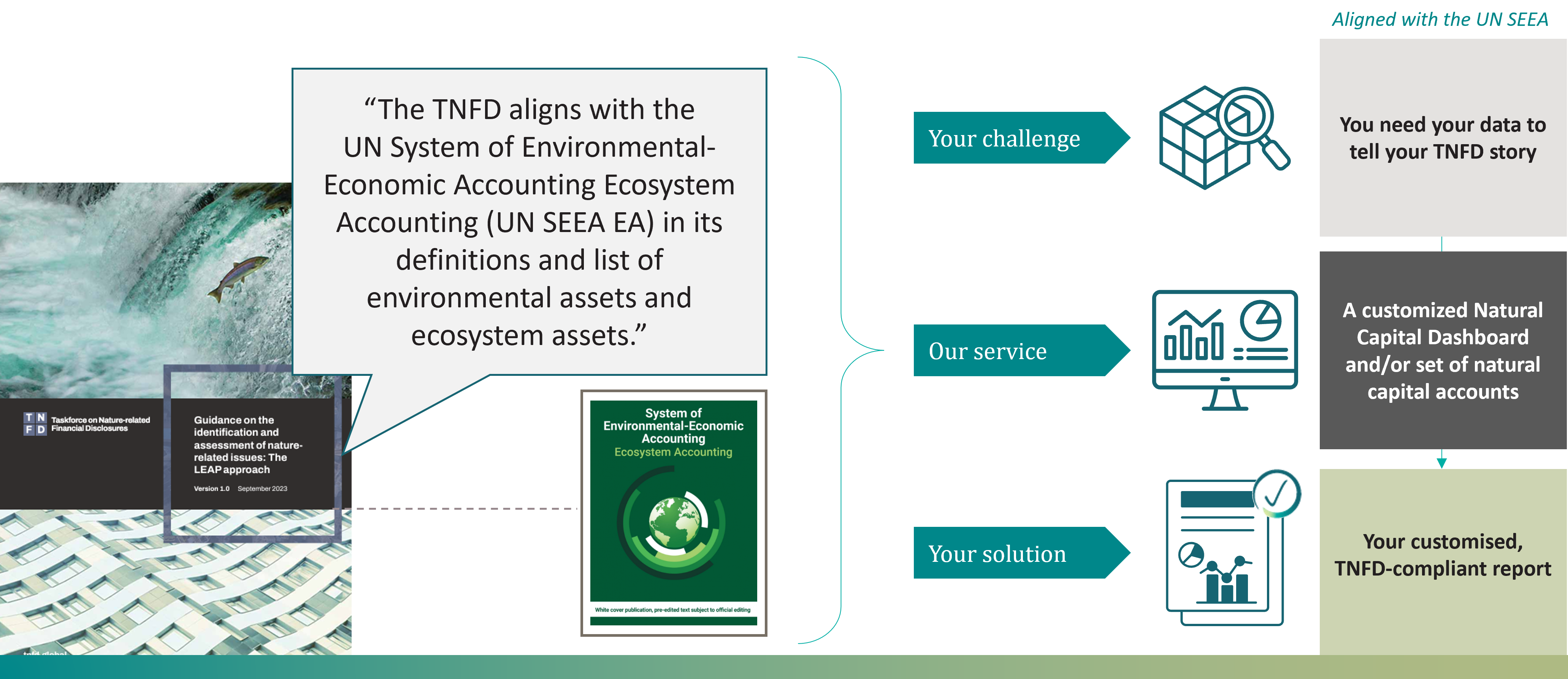

We have a strong understanding of the work of the Taskforce on Nature-related Financial Disclosures (TNFD) and the progress that is being made in this area. Our methodology aligns with each aspect of LEAP:

- Locate – Interface with nature

- Evaluate – Dependencies and impacts

- Assess – Material risks and opportunities

- Prepare – Respond and report

We apply a spatial ecosystem-based approach to support the management of natural capital. This is in line with the United Nations global standards on natural capital accounting described in the System of Environmental-Economic Accounting (UN SEEA).

Organisations can get on the front foot with their nature-based risk reporting and analysis by using natural capital accounting. We help organisations to report on TNFD and environmental, social and governance (ESG) requirements. Our services allow organisations to undertake due diligence, report effectively to stakeholders and investors, and fulfil duty of care obligations.